DAILY TICKER

Building a market brief that busy investors actually trust

Overview

I built Daily Ticker as a complete product from concept to revenue—designing the user experience, implementing the AI analysis pipeline, building the freemium business model, and creating a comprehensive design system.

The challenge wasn't just generating stock picks; it was building trust through transparency (live performance tracking), reliability (95%+ email deliverability), and design quality (LED-inspired terminal aesthetic).

The Live Product

Tech Stack & Architecture

Built on modern, production-grade technologies optimized for reliability, performance, and cost efficiency.

6-Week Build Timeline

Research & Design Foundation

User interviews, design system creation, 14-field brief schema, email template design

Core Automation Pipeline

API integration, AI analysis system, cron scheduling, database architecture

Email Infrastructure

Resend integration, SPF/DKIM/DMARC setup, deliverability optimization (40% → 95%)

Freemium Features

Stripe integration, user authentication, Pro tier gating, archive system, performance tracking

Polish & Launch

Homepage design, landing page optimization, SEO, responsive refinement, production deployment

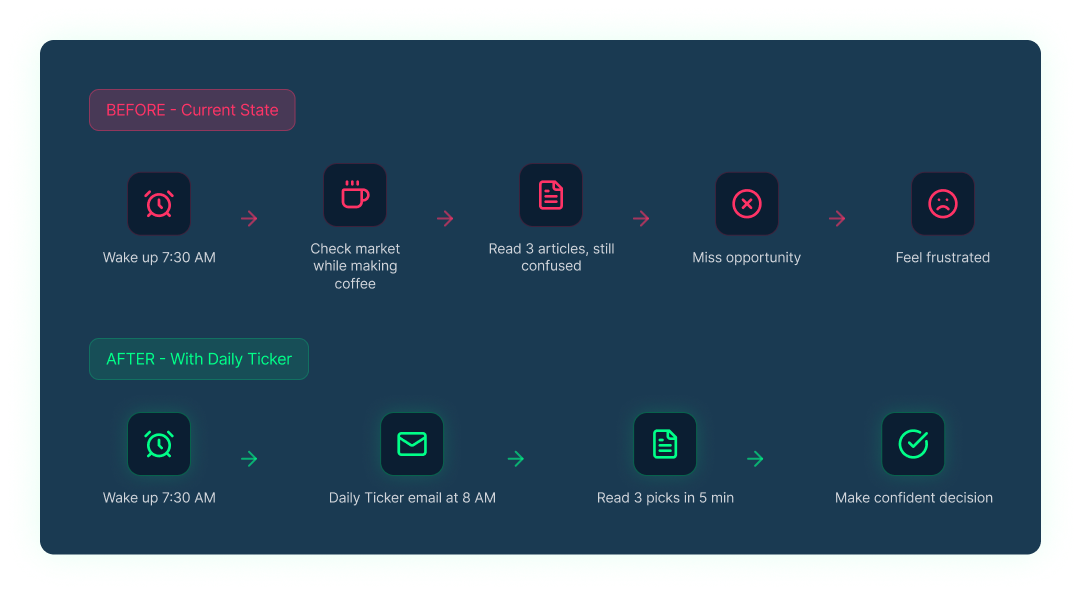

The Problem

Busy investors waste hours researching and still don't know what to do

I kept seeing the same pattern: people with $10-250k portfolios who wanted to stay active in the market but either doom-scrolled CNBC, Reddit, and Twitter and still felt unsure—or gave up entirely and left money sitting idle.

— Busy Builder Brad, tech worker with $85k portfolio

The insight: If I could compress a professional trader's 30-minute morning ritual into a 5-minute daily brief that proves its track record, I'd have a product with real value.

The Daily Ticker User Journey

Designed to fit seamlessly into a busy investor's morning routine—no app to remember, no dashboard to check.

6:00 AM UTC — Automation Runs

System analyzes overnight market data, scans for high-volume stocks with significant movement, filters quality candidates

6:03 AM UTC — Brief Generated

AI generates 1-3 high-conviction picks with complete analysis, risk assessment, and execution plan

6:05 AM UTC — Email Delivered

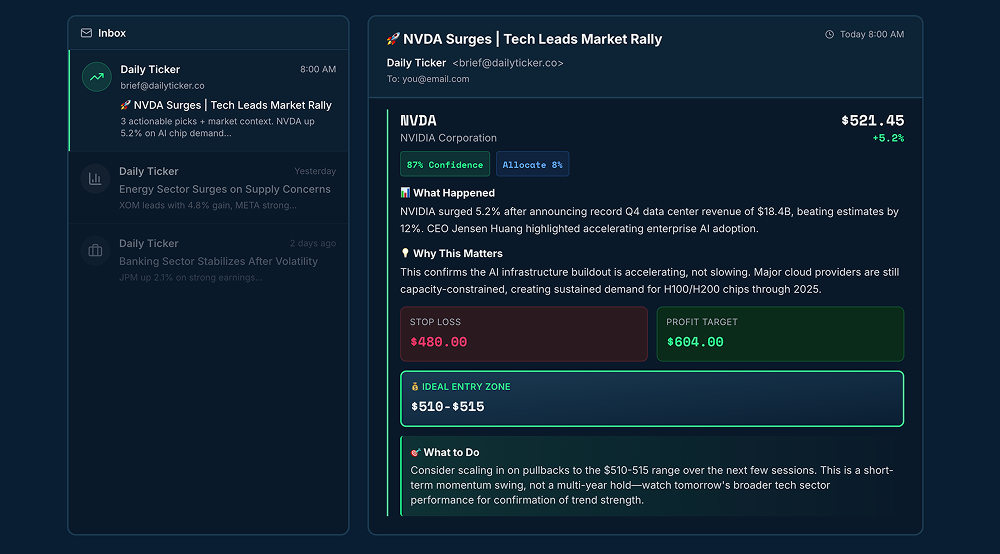

Brief lands in inbox (95%+ delivery rate) with tiered content (Free users see basic analysis, Pro users get full execution toolkit)

8:00 AM EST — User Wakes Up

Checks email over coffee, reads 5-minute brief, knows exactly what's moving and why

8:05 AM EST — Decision Made

User has conviction to act (or not act) based on clear risk/reward analysis, entry zones, and stop-loss levels

Ongoing — Performance Tracking

Archive system stores every pick, performance dashboard tracks accuracy, transparency builds trust over time

The Email Brief: Designed for Clarity & Action

Each daily brief is carefully structured with a 14-field schema that provides everything a busy investor needs: ticker, price, confidence score, analysis, entry zones, stop-loss, profit targets, and portfolio allocation.

Design System & Visual Identity

Built a complete design system from scratch—not just for developers, but as a product feature

Most SaaS products slap together Tailwind defaults and call it a day. I treated the design system as a core differentiator. The LED-inspired aesthetic isn't just "looks cool"—it signals Bloomberg-terminal credibility while remaining accessible to retail investors.

Color System — LED Terminal Aesthetic

Inspired by Bloomberg terminals and LED ticker displays:

#0B1E32 Deep Navy •

#00FF88 LED Green •

#FF3366 LED Red •

#1a3a52 Medium Blue

Typography

Inter — Primary font for all UI text, headings, and body copy

Space Mono — For tickers and LED-style displays

Component Showcase

Badges:

Live 🔒 Pro Most PopularButtons:

Primary CTA SecondaryLED Text Effect:

AAPL $150.25 +2.5%Design Principles

- Professional ≠ Boring — Financial tools can look modern and engaging

- Consistent 4px/8px Grid System — Creates visual harmony

- Motion with Purpose — Pulsing = live, Glow = interactive

- Accessibility Baked In — WCAG AA compliant, keyboard navigation

- Mobile-First Responsive — Scales from 320px to 4K

Complete Style Guide

I built a comprehensive, interactive style guide documenting every design decision. This isn't just developer documentation—it's a living design system that demonstrates the level of craft that went into the product.

View colors, typography, components, animations, and design principles that power Daily Ticker's LED-inspired terminal aesthetic.

View Style Guide →Key Features Shipped

- Fully automated content generation — Zero manual work after setup

- Real-time market data integration — API orchestration with validation

- Intelligent AI analysis — Claude Sonnet 4.5 with quality filters

- Reliable email delivery — 95%+ inbox rate, SPF/DKIM/DMARC configured

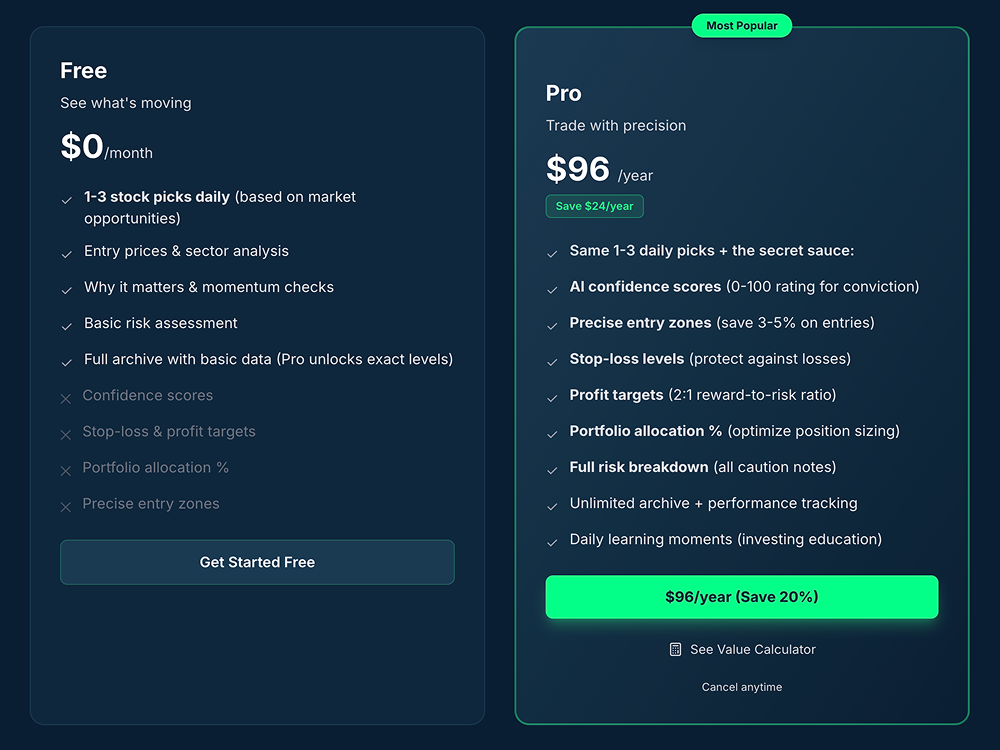

- Freemium business model — Clear value split, Stripe integration

- Performance dashboard — Live tracking of every pick

- Archive system — Date-based retrieval, SEO optimized

- Pro member gating — Blurred content, login modal, upgrade flows

Archive & Performance Tracking

Every brief is archived with date-based retrieval, allowing users to verify historical accuracy and track performance over time. This transparency builds trust—users can see exactly how picks performed.

Free vs Pro: Clear Value Differentiation

The freemium model isn't arbitrary—it's architecturally baked into how data flows through the system. Free tier proves the picks work, Pro tier gives you the execution toolkit.

Technical Architecture

5-Stage Automation Pipeline

The entire system runs daily at 6 AM UTC without manual intervention. Here's how:

Stage 1: Data Collection

Fetch real-time market data, news, sector performance from APIs. Filter for volume >500k and price movement >3%

Stage 2: AI Analysis

Claude Sonnet 4.5 analyzes candidates, generates conviction scores, identifies momentum setups

Stage 3: Quality Validation

Multi-criteria filters ensure no penny stocks, sufficient liquidity, valid price ranges

Stage 4: Brief Generation

Format analysis into tiered briefs (Free vs Pro), calculate risk levels, entry zones, targets

Stage 5: Distribution & Storage

Send emails via Resend (95%+ delivery), archive to Supabase, update performance tracking

Technical Challenges Solved

Email Deliverability Crisis

Problem: 40% of emails were landing in spam. Users signed up but never saw the product.

Solution: Implemented SPF, DKIM, DMARC records, proper sender authentication, tested across all major email providers (Gmail, Outlook, Apple Mail, Yahoo).

Cron Timeout Limits

Problem: AI analysis takes 5-10 minutes, Vercel default limit is 5 minutes. Briefs were timing out mid-generation.

Solution: Upgraded to Vercel Pro (maxDuration: 900), optimized prompt engineering

to reduce token count, implemented intelligent retry logic with exponential backoff.

Data Quality vs. Speed

Problem: AI occasionally included penny stocks or generated invalid data. Trust = destroyed.

Quality Filters Implemented

Solution: Real-time APIs (Polygon.io) provide raw data → Multi-criteria validation filters quality → AI acts as reasoning engine only (not data source). Zero tolerance for inaccurate prices.

Key Learnings

-

For financial products, data quality = product quality

Beautiful UX with bad data is worse than no product. Trust destroyed instantly. -

Email deliverability is non-negotiable

40% spam rate broke the entire user flow. DNS configuration isn't backend work—it's product foundation. -

AI needs validation layers, not blind trust

Multi-criteria validation + token limits = consistent quality. -

Design systems enable trust at scale

Consistency signals professionalism. Every button, badge, and card following the same patterns builds confidence. -

Honest messaging builds more trust than marketing spin

Changed "3 picks daily" → "1-3 picks based on market opportunities." Users respected honesty.

What This Demonstrates

This project showcases my ability to take a product from concept to revenue-generating SaaS in 6 weeks, handling every layer from user research to production infrastructure.

Product Design

User research, design systems, UX flows, visual identity, freemium strategy

Systems Architecture

API orchestration, automation pipelines, database design, cron scheduling

AI Integration

Prompt engineering, quality validation, token optimization, hallucination prevention

Business Model

Freemium tiers, Stripe integration, pricing strategy, value differentiation

Infrastructure

Email deliverability, DNS configuration, performance optimization, deployment

Full-Stack Dev

Next.js, TypeScript, React, Supabase, Tailwind, Vercel Edge Functions

By The Numbers

See It Live

Daily Ticker is live and delivering briefs every weekday. Check out the performance dashboard, browse the archive, or try the free tier yourself.

Want to talk about this project? hello@nikkikipple.com